Understanding the Significance

of Form W-9

- Form W-9 is an IRS Form that can be used to provide your TIN information to the payers.

- The payers will use this form to confirm your TIN and file 1099 Forms at the year-end for you.

- Form W-9 is applicable only to U.S. residents or resident aliens.

- Failing to provide W-9s can lead to a backup withholding of 24% from your income.

For example: If you are a gig worker, you should furnish your W-9 to the business that hired you so that they can file and furnish 1099-NEC for you.

To learn how to complete your

Fillable W-9 Form, click here.

Ready to Start Filling out Form W-9?

Fill Form W-9 NowFill Out, E-Sign, and Download or Share Your

Form W-9!

ExpressW9 provides a secure option to sign your Fillable W-9 Form electronically so you can go paperless.

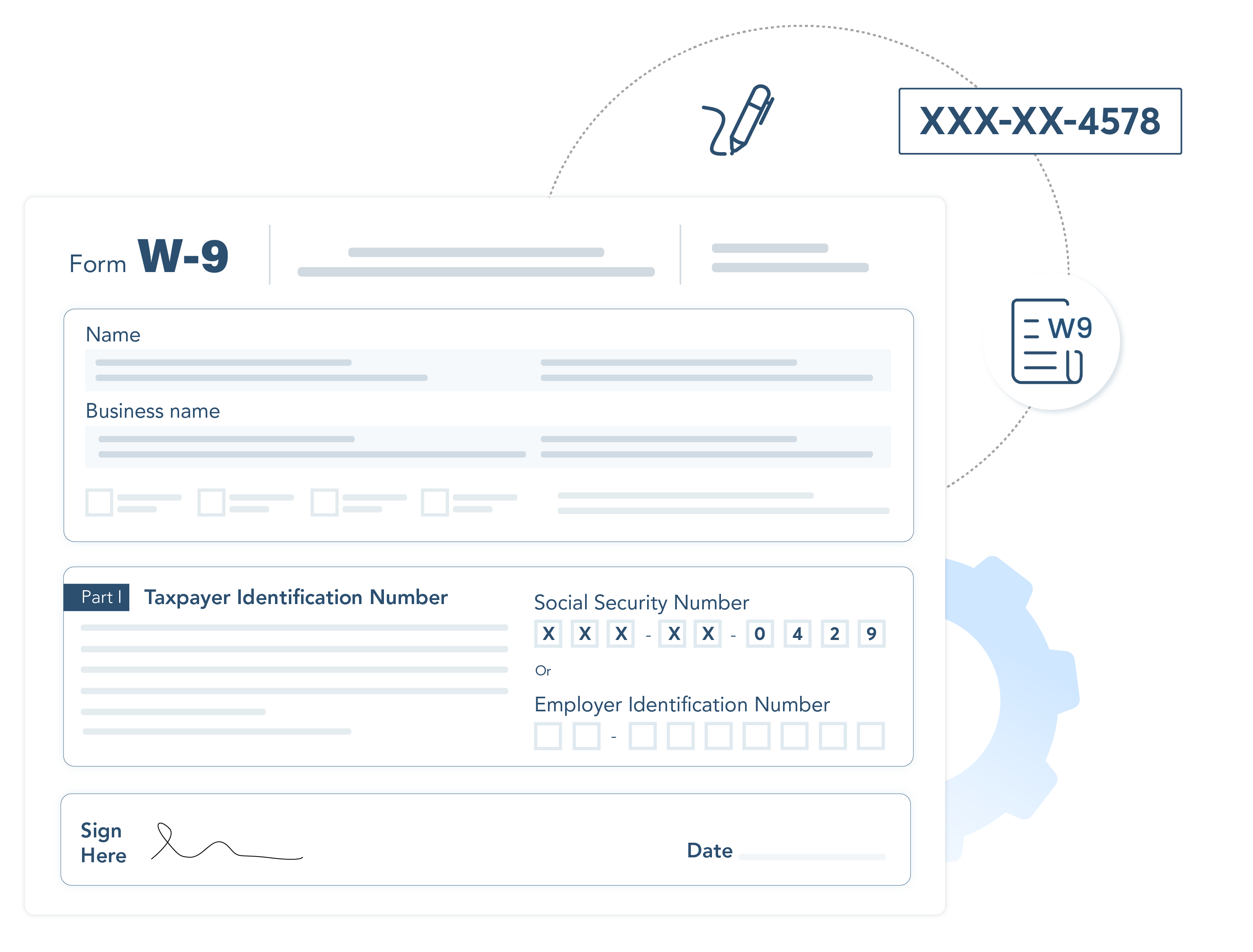

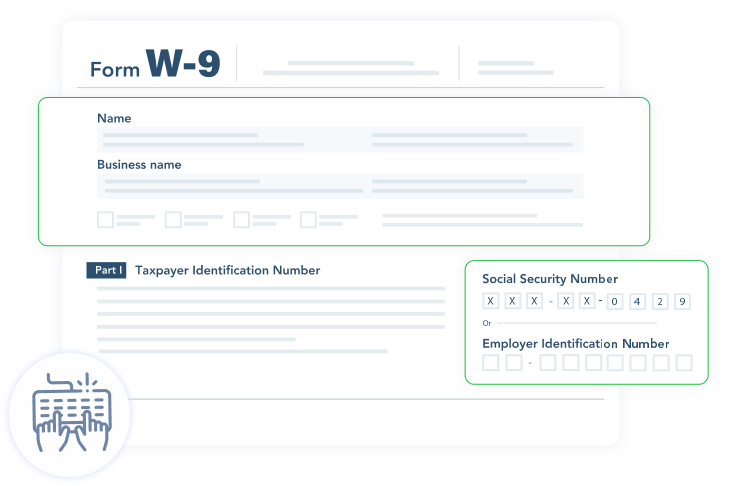

1. Fill in the W-9 Information

Fill in the required W-9 information, including your Name, Address, TIN, Federal Tax Classification, etc.

Click here for step-by-step instructions to complete Form W-9.

2. E-Sign Form W-9

After filing out the W-9, you can review the information and edit it if needed. Once complete, you can proceed to sign your Form W-9 electronically.

3. Download or Share Your

Form W-9

Now, you have the option to either email the W-9 directly to your payers from ExpressW9 or download the PDF to print and distribute it yourself.

Ready to Start Filling out Form W-9?

Fill Form W-9 Now

An Easy, Cloud-Based Solution for Completing and Sharing a

Fillable W-9 Online!

Easy W-9 Completion

Choose to enter your information directly on the form, or by using our interview-style method.

Seamless E-signature Option

ExpressW9 provides a secure option to sign your Fillable W-9 Form electronically so you can go paperless.

W-9 Data Validations

The ExpressW9 application performs basic data validations to improve the accuracy of your W-9 Form.

Electronic Sharing Option

Complete, e-sign, and share your W-9 directly with your payers in minutes.

Secure W-9 Storage

The W-9 forms you create with us are stored securely and are always available for you to access, edit, and share.

Form W-9 Manager

Payers can use our Form W-9 Manager to easily request, collect, and manage their vendor’s W-9s from one secure platform.

Instructions for Filing Out Form W-9

Box 1 - Name

Enter your name in this field. This needs to be the same name that appears on your tax returns. If you file a joint tax return, you should only list your name on this W-9 Form.

Box 2 - Business Name

If you have a business name (other than the one entered in Box 1), you can enter it here. Otherwise, you can leave this field blank.

Box 3 - Federal Tax Classification

Check the box to indicate your federal tax classification, the options are Individual/sole proprietor or single-member LLC, C Corporation, S Corporation, Partnership or Trust / Estate.

Box 4 - Exemption Codes

If you are exempt from Backup withholding and/or FATCA Reporting, you can indicate this by entering the appropriate exemption code in this box.

Box 5 & 6 - Address

Your address should include the street, apartment/suite number, city, state, and zip code. This is the address where the payer will send copies of your information returns.

Box 7 - Account Number(s)

Box 7 is an optional field. If this applies to you, enter the account number in this box.

Part I - Taxpayer Identification Number (TIN)

This is the section where you are required to provide your TIN. If you are an individual, you should enter your Social Security Number (SSN), and if you are a business entity, you should use your Employer Identification Number (EIN).

Part II - Certification

In this section, you are required to acknowledge that,

- You are providing the correct taxpayer identification number

- You are not subjected to Backup withholding

- You are a U.S. citizen

- The FATCA code(s) entered on this form (if any) is correct

If you are subjected to Backup withholding, you must cross out the second line. For more information about Backup withholding,

click here.

Payers can Seamlessly Collect and Manage W-9s from their Vendors

TaxBandits offers a streamlined solution, our W-9 Manager! This enables you to request

and collect W-9s electronically and manage them from one secure platform.

Frequently Asked Questions

- Independent Contractors

- Gig Workers

- Freelancers

- Consultants

- Other individuals or entities that receive business-related payments

- No, the Form W-9 is not meant to be submitted to the IRS. It is a document created by the IRS to facilitate the exchange of TIN information between payers and their payees.

- Payers use the information provided by their payees on the W-9 to complete 1099s and other relevant information returns for the IRS.

- Not supplying your accurate TIN on a W-9 to your payer can lead to the IRS applying a 24% backup withholding on your payments.

- If you fail to provide an accurate TIN to your payer, the IRS may also impose an additional $50 penalty.

Under any of the following conditions, the IRS requires the payers to withhold 24% of taxes from the payments they make to you.

- You haven't furnished your TIN to the payer

- You haven’t certified your TIN when required

- The IRS notifies the payers that you have furnished an incorrect TIN

- The IRS notifies the payers that you are subject to backup withholding

- You haven’t certified to the payer that you are not subject to backup withholding under any of the above conditions

A W-9 form does not have a designated expiration date unless the information you provided on it requires an update.

For instance, if the address you provided on a prior W-9 has changed, you must fill out a W-9 again with the updated address and furnish it.

Yes! You can edit your completed printable W-9 and share it with your payer(s) again.